LONDONDERRY NH – FEBRUARY 2026

As a business owner, you’ve probably heard about Section 179 and its tax deduction benefits. But what exactly is Section 179, and how can it impact your business?

What is Section 179?

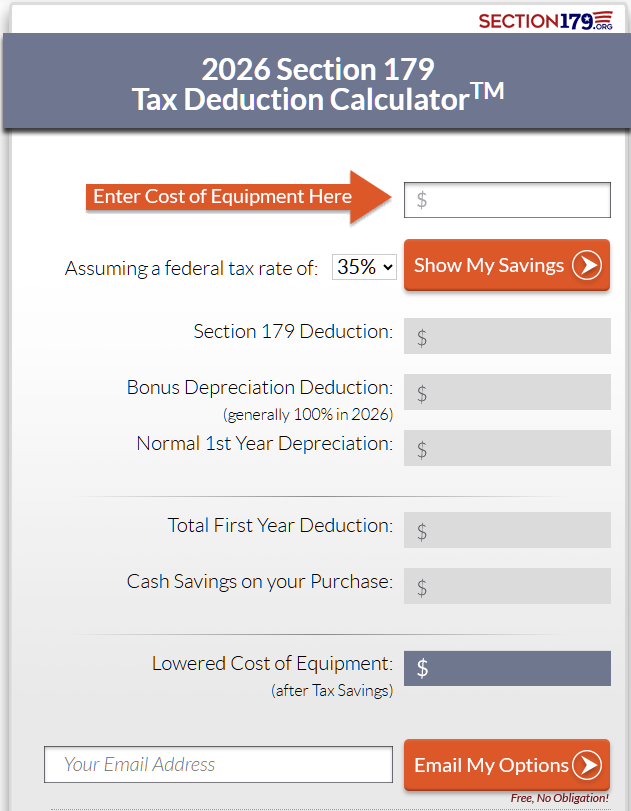

Section 179, a part of the U.S. tax code, offers businesses tax incentives for purchasing capital equipment. In 2026, the Section 179 tax deduction limit increased significantly. Businesses can now deduct up to $2,560,000 for eligible capital equipment, while the spending cap rose to $4,090,000 for equipment bought in the same tax year. The Section 179 website is a valuable source for current tax law updates and provides a handy calculator tool. This tool aids financial planning, ensuring your facility remains up-to-date, safe, and efficient.

How to Benefit from Section 179

Section 179 is a game changer for many businesses by allowing them to immediately write off certain purchases, reducing taxes for capital equipment. To qualify, the equipment must be “New to you (new or used is OK, but it must be newly acquired by your business), used more than 50% for business, and placed in service during the tax year.” We specialize in implementing capital equipment as lasting solutions that enhance your facility.

Examples of capital equipment could be a mezzanine for increasing usable space or boosting operational efficiency and safety with a VRC lift. Section 179 allows for the implementation of these types of material handling solutions without a hefty upfront tax burden. Adding material handling solutions not only improves your facility but also offers financial benefits through Section 179.

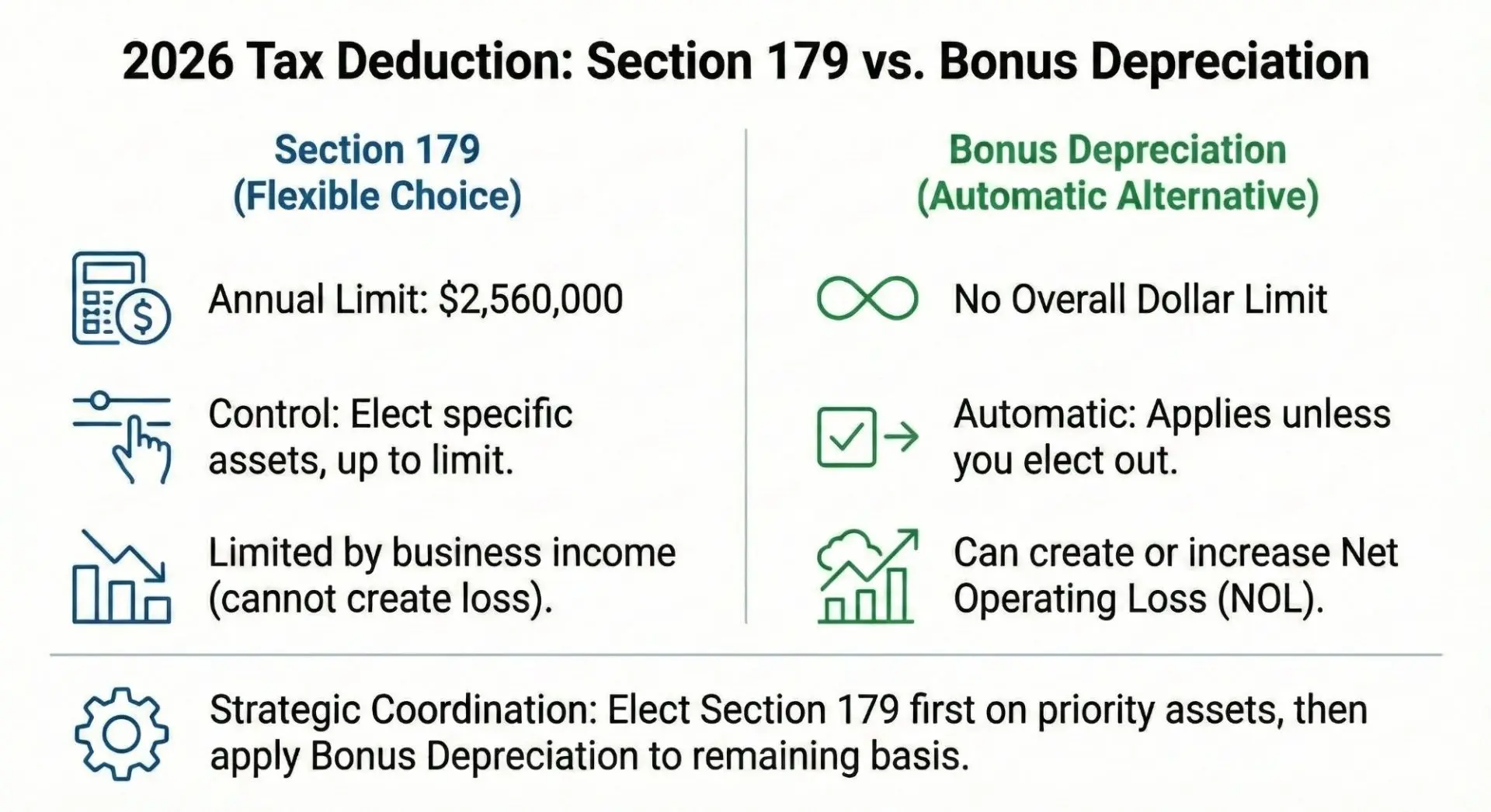

Section 179 deductions can be strategically combined with bonus depreciation in the same year to further maximize your first year savings. Bonus depreciation allows a business to deduct 100% of the cost of the equipment immediately instead of depreciating it over several years.

While this rate was previously scheduled to decrease, the One Big Beautiful Bill Act permanently restored it to 100% for assets acquired and placed in service after January 19, 2025. By utilizing these provisions together, businesses can achieve a near-total write-off for critical facility upgrades in the current tax year.

We Can Help

Understanding Section 179 and using it to your advantage can provide significant benefits to your business. If you are interested in taking advantage of this deduction, contact us or call us at 800-797-5699. We’re here to help you maximize Section 179’s benefits and fuel your business’s growth!