What is Section 179

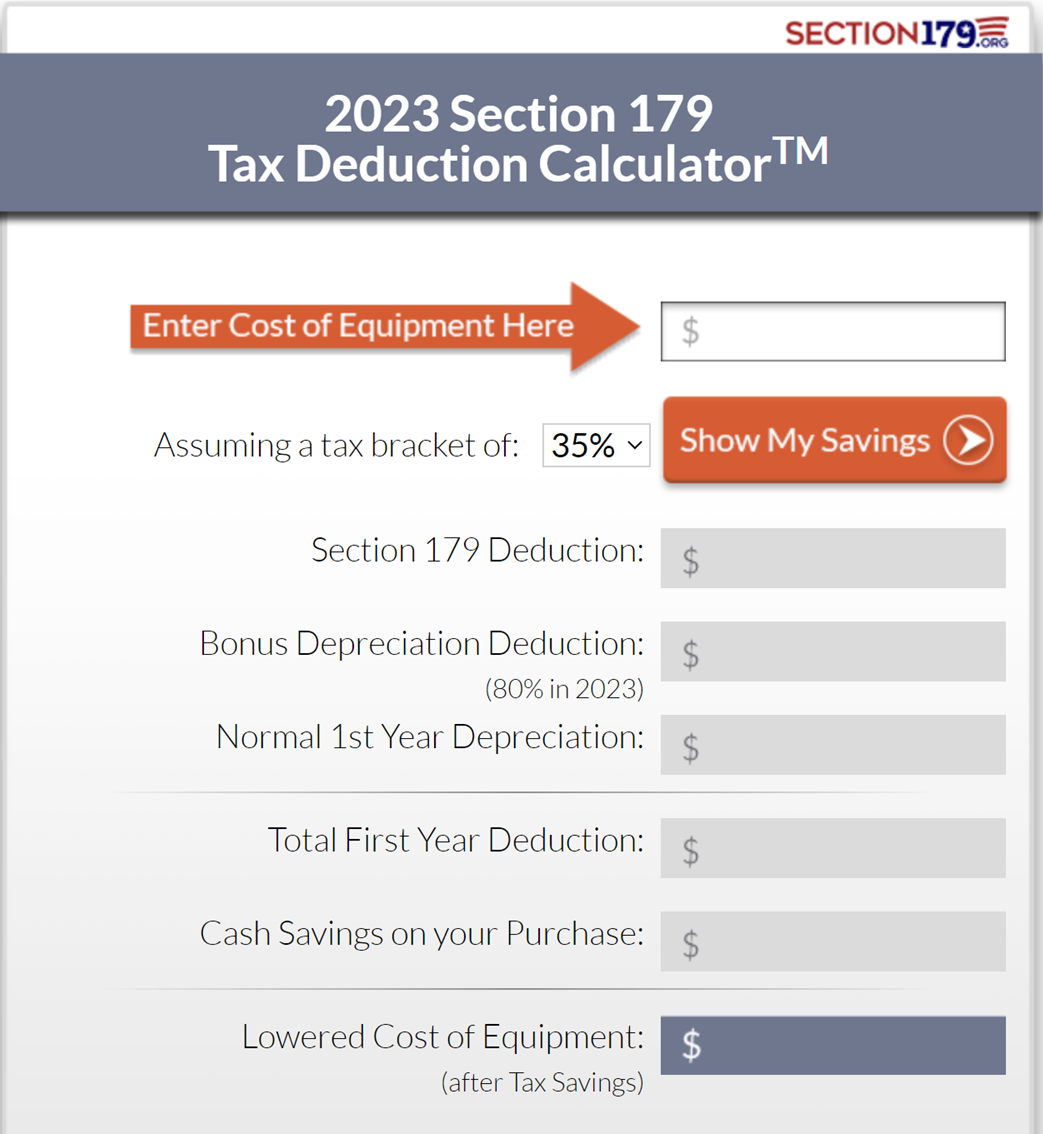

Section 179, a part of the U.S. tax code, offers businesses tax incentives for purchasing capital equipment. In 2023, the Section 179 tax deduction limit increased significantly. Businesses can now deduct up to $1,160,000 for eligible capital equipment. While the spending cap for eligible capital equipment rose to $2,890,000 for equipment bought in the same tax year. The Section 179 website is a good source to check out current tax law updates and provides a handy calculator tool This tool aids financial planning, ensuring your facility remains up-to-date, safe, and efficient.